According to the 2023 World Energy Transitions Outlook, global investments in energy transition technologies reached USD 1.3 trillion in 2022. However, mobilizing clean energy investment at the local level remains a significant challenge, one that 100% renewable energy-committed governments such as West Nusa Tenggara (WNT), Indonesia must overcome.

To encourage multi-level knowledge-sharing towards this end, ICLEI Indonesia in collaboration with the CASE project of GIZ conducted a virtual capacity-building series for WNT’s local governments titled “Innovative and Alternative Funding Mechanism” on 4 July 2023.

The event saw the participation of the Indonesian Ministry of National Development (BAPPENAS) and PT SMI Persero, an infrastructure financing state-owned enterprise.

Following a previous session which introduced various financing mechanisms, the latest capacity building event aimed to explore viable alternative funding mechanisms, as well as share success stories on green infrastructure financing practices across cities and regions in Indonesia.

Indonesia’s commitment for electricity transformation towards net-zero by 2060

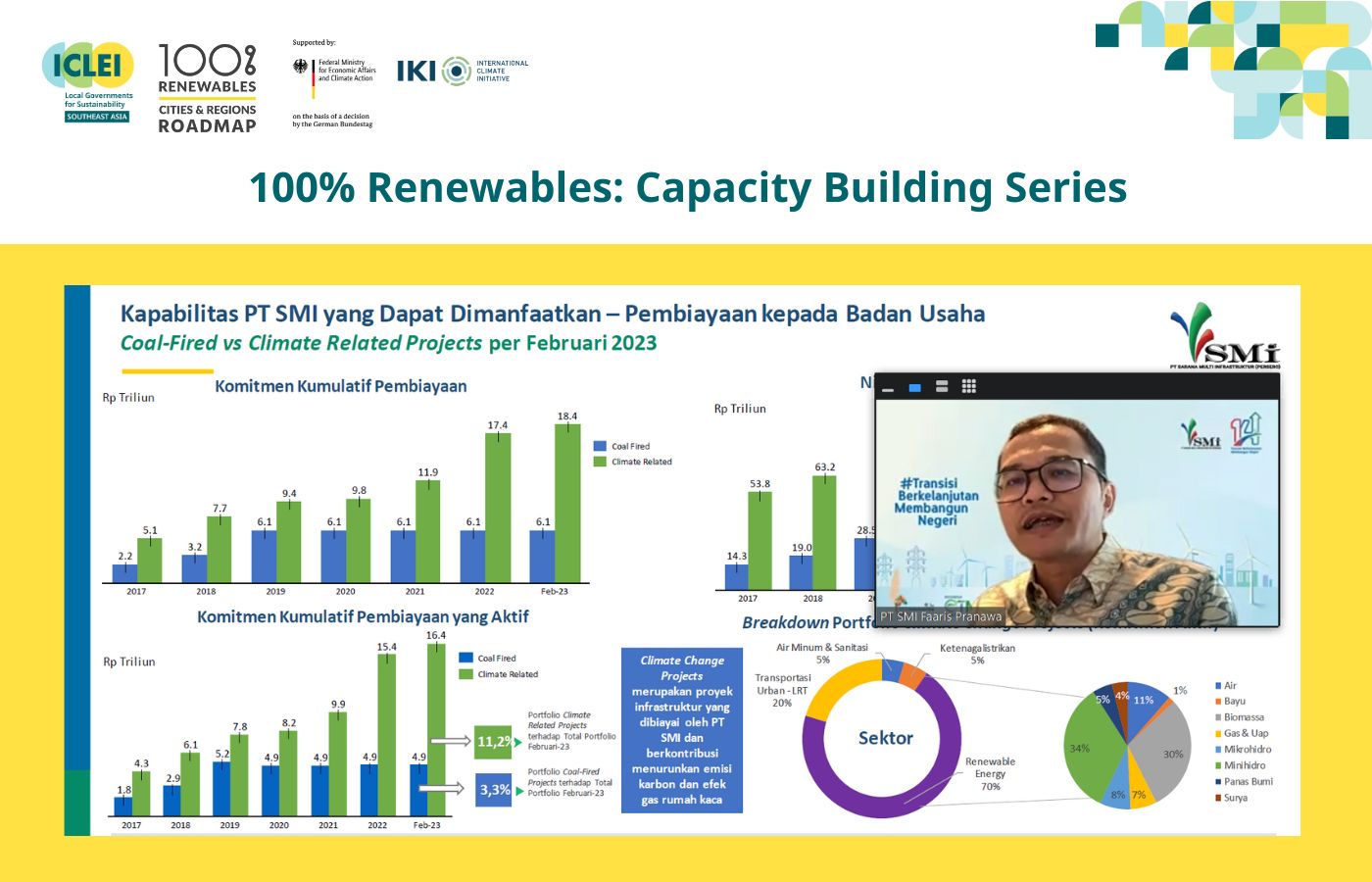

(In the photo above) Faaris Purnawa, the director of public finance and project development at PT SMI.

Delivering his keynote speech, Rachmat Mardiana, director of electricity and telecommunication at BAPPENAS, pointed out that the national policy framework for electricity transformation will be focused on renewables acceleration, smart grid interconnectivity, EV adoption, and building subsidy and incentive regulations.

“Asset securitization, green bond, seed capital, convertible grants, and finance channeling are among the best financing practices that can be explored for green infrastructure development. Nationally, the state/regional fiscal budget (APBN/APBD) will necessitate project readiness that aligns with the current policies and development plans,” said Mardiana.

PT SMI: Innovative and alternative funding facility for local governments

Established in 2009 as a State-Owned Enterprise (SOE) under the Ministry of Finance, PT SMI’s public loan facilities aim to provide alternative financing to local governments that encourages simultaneous policy and institutional reforms, as well as achieving the national and sub-national development targets.

(In the photo above) Faaris Purnawa, the director of public finance and project development at PT SMI.

Highlighting WNT’s credit capacity and opportunities for public loans, Faaris Purnawa, the director of public finance and project development at PT SMI, explained the province has a high potential to access public financing for infrastructure development.

“WNT Province has the largest loan capacity for a 5-year tenor, which is around IDR 2.2-trillion. The average local government in WNT has a loan capacity of IDR 268-million at a 5-year tenor. As a whole, the borrowing capacity of local governments in WNT is IDR 4.8-trillion” explained Purnawa.

With mandates to support the accomplishment of the sustainable development goals and commitment to financing infrastructure projects that contribute to decarbonization, PT SMI has financed 61 climate change projects with a financing commitment of IDR 18.4-trillion and a project value of IDR 89.7-trillion, much higher than 10 current coal-fired projects with a commitment of IDR 6.1-trillion and a project value of IDR 28.5-trillion.

Takeaways on green investment criteria

Below are some of the green investment criteria that local governments should consider for their renewable energy project proposals.

- Mitigation impact: Indicators on the estimated GHG emission reductions during program/project implementation.

- Adaptation impact: Acquiring actual and measured changes in number of casualties, the value of physical assets, livelihoods, and/or environmental or social losses due to disaster impacts related to extreme climate conditions and climate change.

- Shifting in paradigm: The project proposal should be able to envision a paradigm shift through innovation, scale-up, replication, knowledge reinforcement, and learning amplification.

- Sustainable development: environmental, social, economic, and development co-benefits that positively contribute to gender equality.

- Beneficiary needs: Financial, economic, social, and institutional needs and barriers to accessing climate change finance from domestic (public), private, and other international sources.

- Country ownership: capacity for project implementation, alignment with national strategies and policies.

- Effectiveness and efficiency: able to provide strong arguments on how the program/project is cost-effective and efficient.

ICLEI Indonesia has been assisting WNT with the needed resources to establish its local clean energy framework. It is expected that the region will soon finalize potential bankable projects to accelerate its energy transition.